There are many popular business reporting and credit analysis systems and agencies available. Some are standard for organizations around the world. The D-U-N-S number is one such identifier number assigned by Dun & Bradstreet that acts as a unique identity for businesses.

From enrolling for Apple’s Developer Program to establishing the creditworthiness of your business, a D-U-N-S can be vital for many goals and business-related processes. Stay tuned and learn all that you need to know about the D&B number.

In this blog

- Who needs a D-U-N-S number?

- What is a D-U-N-S number used for?

- How to get a D-U-N-S number?

- Frequently asked questions

What is Dun & Bradstreet?

Dun & Bradstreet Holdings, Inc., headquartered in Florida, is an American company that assigns and maintains the D-U-N-S number. It is a credit rating agency that also provides commercial data, analytics, and insights for businesses.

From risk and financial assessment services to a wide range of products for operations & supply, and sales & marketing, the company has a diverse portfolio. Their database contains over 500 million business records worldwide and it serves commercial industries as well as governments.

Dun & Bradstreet, also known as D&B, generates revenue through subscription-based products, business information reports, data licensing agreements, strategic partnerships, and concierge services. Following 180+ years of legacy, D&B is a reliable name in the US and around the world.

What is a D-U-N-S number?

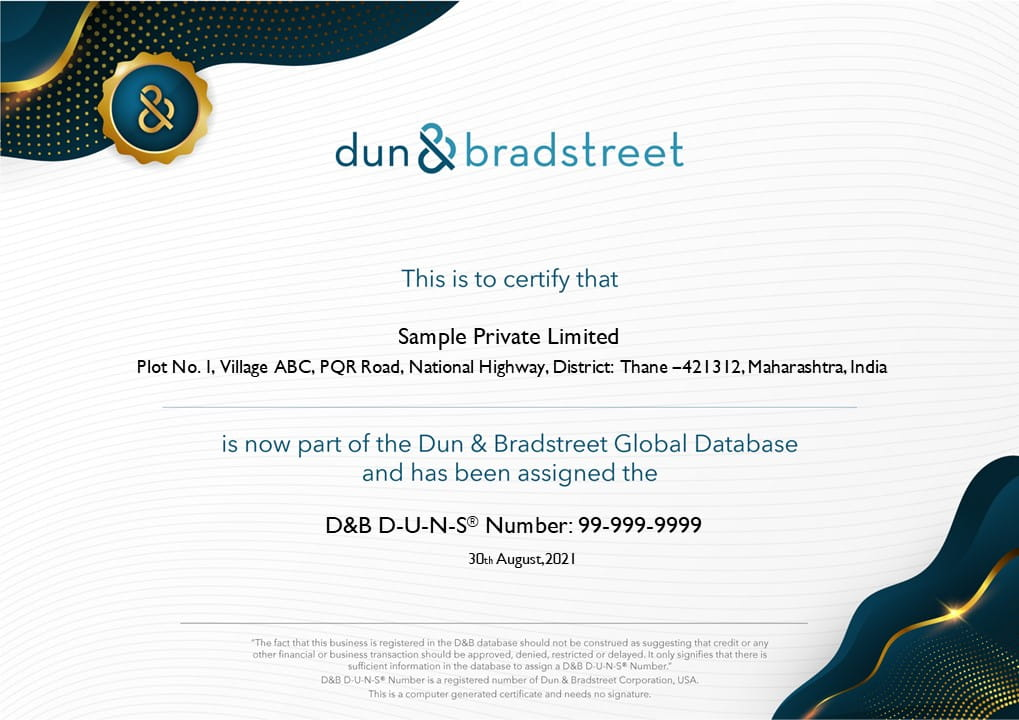

D-U-N-S (also written as DUNS) stands for Data Universal Numbering System. It is a proprietary system developed and managed by the Dun & Bradstreet (D&B) company that assigns the DUNS number to a business entity.

Thus, a D-U-N-S (or DUNS) number can be defined as a unique numeric identifier for businesses. It is a random number where the digits themselves do not signify anything special other than creating a unique identity for the business. It was introduced in 1963 to support D&B’s credit reporting practice and has become a global standard.

The DUNS database contains more than 300 million entries of businesses from around the world. Its users include the European Commission, the United Nations, and Apple. Moreover, 50+ global industry and trade associations recognize, recommend, or require DUNS for extending their merits and services to businesses.

Additionally, DUNS numbers are used by creditors, vendors, and suppliers to verify the credit history and financial health of any company. The number gets linked to the business’ credit profile, which includes multiple credit scores that assess the risk potential of the organization.

While getting a D-U-N-S number is not mandatory for the existence of a business in general, it may be obligatory in certain cases. For example, it is mandatory for Apple’s Developer Program for publishers that want to sign up and publish iOS apps as an organizational entity.

Thus, applying for a D-U-N-S number can be a viable idea. It can help you keep track of your business credit and risk potential alongside a range of other factors. It can also help you establish the legitimacy and creditworthiness of your business and get better deals when it comes to loans or other financial arrangements.

D-U-N-S is often confused with similar legal and commercial identification number systems. Here are a few examples of how these systems differ from the D&B D-U-N-S number:

DUNS vs EIN

An EIN or Employer Identification Number is a unique nine-digit number assigned by the IRS (Internal Revenue Service) in the United States. It identifies a business entity for tax and legal purposes.

EIN is formatted as 12-3456789 and is required for businesses to file taxes, open bank accounts, and apply for business licenses in the United States. While D-U-N-S is issued by D&B – a private agency, EIN is a code allocated by a government agency. It is US-centric and primarily used for employee tax purposes.

DUNS vs EORI

EORI stands for Economic Operators Registration and Identification Number. It is an identification number assigned by the customs authorities in the European Union (EU) member states to register a business or person for customs purposes.

The format of an EORI number may vary by country but typically includes a country code followed by a unique number (For example: XY123456789000). It is essentially used to identify businesses and individuals who import or export goods to and from the European Union.

DUNS vs LEI

The Legal Entity Identifier, also known as LEI code or LEI number, is a unique global identifier for legal entities participating in financial transactions globally. LEI is issued by various Local Operating Units (LOUs) that are accredited by the Global Legal Entity Identifier Foundation (GLEIF).

An LEI number is written in the format of a 20-character alphanumeric code. Its core purpose is to help identify legal entities through a globally accessible database. It provides information about a legal entity’s ownership structure and is used for facilitating transactions, regulatory filings, and risk management.

DUNS vs UEI

Like DUNS, the UEI or Unique Entity Identifier number is also a business identifier number used across all US federal agencies. It is issued by The System for Award Management (SAM), which is overseen by the General Services Administration (GSA) in the United States.

The UEI replaced the DUNS number as the unique entity identifier used across the federal government on April 4, 2022. This means that entity registration, searching, and data entry in the SAM.gov portal of the US government now require the use of the new Unique Entity ID. The 12-character alphanumeric code is used for federal grants, contracts, and other awards.

Side Note: While DUNS is a global standard, its other counterparts like UEI are more specific to a location or federal systems. These are like Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs) but for businesses and entities.

Who needs a D-U-N-S number?

In general, a DUNS number is not mandatory. However, it may be imperative for entities in specific scenarios. Therefore, it can be viable for all kinds of businesses to get a DUNS number. For example, the following types of entities can leverage the merits of a DUNS number:

- Businesses: Large corporations, Small and Medium Enterprises (SMEs), startups, etc. can use it for global identification, credit and trust building, and more.

- Suppliers and Vendors: Suppliers may need a DUNS number for their identification and credit analysis when working with large companies and participating in global supply chains.

- Exporters and Importers: DUNS numbers can be used to facilitate trade with international partners and establish their credibility.

- IT-based platforms: DUNS number can facilitate tech partnerships, cloud service agreements, and more, for tech companies.

- Financial entities: Banks and Credit Unions can leverage the DUNS number for risk assessment, credit reporting, and corporate transactions and exchanges.

- Educational institutions: Schools, colleges, universities, etc., may require a DUNS number for receiving federal funds and research grants.

These are some examples of entities and various scenarios where a DUNS number can help them. Other than that, a DUNS number may also be used for other purposes. For example, some nongovernmental loans and small-business grants also require entities to have a DUNS number for processing their application.

What is a D-U-N-S number used for?

While there is no obvious downside to it, having a DUNS number can be beneficial for your business in many ways. For example, businesses and app owners in the healthcare industry may need it for certain compliance and regulatory processes.

Entities can use the DUNS number for the following purposes:

Ensuring global business identification

The first and foremost importance of a DUNS number is that it helps your business in getting a recognition or identity that is accepted globally. It distinguishes your business from others and ensures consistency across various global databases and systems. Since DUNS is standard worldwide, it also allows you to establish your business in the global market.

Establishing credibility and creditworthiness

A DUNS number allows businesses to build a credit profile with Dun & Bradstreet. This profile can be used by other entities and organizations to assess your creditworthiness and financial stability. It also allows businesses to assess their potential partners and avoid financial risks and pitfalls. Moreover, it can help businesses interact with other platforms like Apple and avail their services and benefits as a legitimate business.

Facilitating loans, funding, and grants

While DUNS has been replaced with UEI on the SAM portal in the US, it is still a standard across the rest of the world. Thus, a DUNS number backed by a strong credit profile with D&B can earn you better deals and favorable term agreements when applying for loans and insurance. It can also facilitate funding and grants, thereby aiding your growth and expansion.

Suggested Read: All you need to know about GDPR and other regulatory policies

How to get a D-U-N-S number?

DUNS number registration is an easy process. Any business can apply for a DUNS number online from anywhere in the world. In this section, we will break down the process of registration and make it easier for you to understand.

Requirements for DUNS registration

Let us first understand the basic requirements for getting a D&B number. To register for a D-U-N-S number, you’ll need to provide the following information:

- Legal name (the official name of your business or entity).

- Name and address of the headquarters.

- Doing Business As (DBA) or other name by which your business is commonly recognized.

- Physical address, city, state, and ZIP Code.

- Mailing address (if separate from headquarters and/or physical address).

- Telephone number.

- Contact name and title.

- Number of employees at your physical location.

- Whether you are a home-based business.

Steps for applying for a DUNS number

Once you have the above information handy, you can apply for a DUNS number online by following the steps discussed below:

- Step 1: Use the DUNS lookup tool to find out if your business already has a DUNS number. A DUNS number can get assigned even if you haven’t requested one. This may happen if a financial institution requests information about your company. If you do not have a DUNS number, you can move to Step 2.

- Step 2: Go to the official Dun & Bradstreet’s website to initiate the application process. Enter the required details about your business. For instance, you may need to provide the business formation date, legal name, address, contact information, industry type, and so on. Other required details may include the name of the owner, legal business structure, employee strength, and more.

- Step 3: Submit the application and wait up to 30 business days to get the number. However, if you want to expedite the process, you can pay the fees for the same and make your request. This will cost you around 300 US dollars and you will be able to get your number within eight business days.

- Step 4: Validate the information you provided and respond to any correspondence from Dun & Bradstreet if required during the due process. Once you receive your DUNS number (via email), you can check it in the DUNS database using a lookup tool as described in Step 1.

- Step 5: If you have your offices in more than one location, repeat the process for each of your business locations. Remember that D&B requires every branch office of every organization to have a different D-U-N-S number.

This was the process of obtaining a D-U-N-S number for your business. Once assigned, the number stays with your business for perpetuity. However, you may be required to update your business information in the D&B records on a yearly basis.

Wrapping up

That was our complete and detailed guide on DUNS number. If you are an app publisher interested in iOS app development or just a business wanting to establish a unique and legitimate identity for credit tracking and financial transactions, the DUNS number is the way to go.

You can register for a DUNS number for your business and get one. It will make your app publishing process seamless. Additionally, it will also help you get recognition as an authentic entity and facilitate your business processes, financial arrangements, and more.

If you find this article interesting, do not hesitate to share it with your family, friends, and peers. You can also explore our other blogs on a vast range of topics or simply try out our free app generator while you are at it. It is no-code, lightning-fast, super-easy, and affordable.

Frequently asked questions

What is a D&B number?

The D&B number is a unique, nine-digit identifier for businesses that is allocated by the credit bureau Dun & Bradstreet, a company that provides commercial data, analytics, and insights for businesses. D&B number, also known as D-U-N-S number, has become a standard numbering system for identifying businesses across the globe.

Who can apply for a DUNS number?

Almost all businesses irrespective of their size, structure, age, or location can apply for a DUNS number. This includes Corporations, Limited Liability Companies (LLCs), Sole Proprietorships, Partnerships, Government Entities, Educational Institutions, Non-profit Organizations, and so on. While it is not mandatory to have a DUNS number, it can help entities establish their legitimacy and credit history.

Why does Apple require a D-U-N-S number?

Apple asks for the D-U-N-S number from publishers that want to list themselves as an organization while filling out the Apple Developer Program Enrollment forms. It is a significant step for those who want to publish applications on the Apple App Store. This is done to verify and authenticate the existence and legal status of the organization or business. It also helps Apple prevent unauthorized or fraudulent entities from accessing developer resources and distributing apps.

Can individual app publishers get a D-U-N-S number?

Yes, as per the official DUNS website, solo all publishers can also register for a DUNS number. However, the publisher will not be listed in the records as an individual. As per the database, the publisher will be considered as an entity. Therefore, individual app publishers who want to be known as a business can also apply for a DUNS number.

What is a D-U-N-S number lookup tool?

A D-U-N-S number lookup tool is a resource provided by Dun & Bradstreet or its authorized partners that allows users to find and verify the D-U-N-S number associated with a business entity. One can look up the D-U-N-S number of a company by providing necessary information such as company name, location, etc. Such a tool can be used to track the credit records and credibility of any business entity.

What is a DUNS number example?

A DUNS/D-U-N-S number is a unique nine-digit identification number assigned to businesses by Dun & Bradstreet, a US-based company that provides commercial data, analytics, and insights for businesses. The number can be written in the format of 12-345-6789. One can also omit the dashes and write the number in the format 123456789.

How long does it take to get a DUNS number?

It can take anywhere up to 30 business days to get your DUNS number after submitting your application. US-based companies with proper documentation can get the number faster. Moreover, businesses that need to expedite the process can submit a quick processing fee of around 299.99 (approx. 300) US dollars. This fastens the delivery process and enables businesses to get a D-U-N-S number within eight business days.

How much does a DUNS number cost?

Essentially, the process of getting a D-U-N-S number is free. However, the company charges a fee from businesses that wish to speed up the process. This costs around 300 US dollars. However, if you do not wish to expedite the process, you can submit your application free of cost and get a D-U-N-S number within 30 business days.

Does a DUNS number expire?

No, a D-U-N-S number does not expire. According to Dun and Bradstreet, the company that assigns D-U-N-S numbers: “The D-U-N-S Number is constant—it stays with a business throughout the lifecycle including name, address and corporate structure changes and even bankruptcy.” Moreover, a DUNS number is never renewed, repurposed or reused, even after a company has gone out of business.

Is DUNS only for US companies?

The D-U-N-S proprietary system is applicable globally. It is used in many countries as a standard business identifier. This includes the UK, Australia, Canada, India, and so on. There are more than 300 million entries of businesses from around the globe. DUNS users include the European Commission, the United Nations, and Apple. Additionally, more than 50 global industry and trade associations recognize, recommend, or require DUNS.